In the early 20th century, national crises, such as the dot-com bubble, September 11, and the war in Afghanistan, led the US government to pursue a policy of low interest rates as part of a strong economic stimulus package. Although the main goal of this initiative was to create corporate investment and private consumption, it caused huge loans for households. In 2004, this led to the termination of the policy of low interest rates, as a result of which financial institutions could not obtain loans. Large financial security companies in the United States, such as New Century Financials, went bankrupt. The scandal caused a global credit crisis and hit the real economy. One of the most famous examples of the global financial crisis is the collapse of the investment bank "Lehman Brothers" in 2008.

One of the most interesting events is the birth of the post-revolutionary system and the crypto currency called "Bitcoin", which was first invented by Satoshi Nakamoto after the collapse of Lehman Brothers. Rumors about who Satoshi Nakamoto is, do not subside, as his personality remains completely veiled. The clear message he is trying to convey in his dissertation, consisting of about nine pages, is the lack of confidence in the banking system, especially the Federal Reserve Bank (FRB), which is the central publisher and trustful third party and manages all information and politics after the experience financial crisis in 2008. He proposed a currency system that can not be fabricated and can be completely transparent without requiring personal information to "replace" existing systems.

Satoshi Nakamoto deduces the definition of distribution from the ancient times of Plato. In particular, his discussion shows analogies to John Rawls' book The Theory of Justice, where a moral and political philosopher emphasizes the importance of justice. Rawls argues that justice can exist only when distribution procedures are valid.

In more detail, considering how these comments relate to the blockade, John Rawls uses the term "Fair procedure" to explain the "veil of ignorance" and claims that information solves asymmetry. Blocking is a chain of blocks that are subject to public trading principles that can not change the content. More importantly, all relevant records will be disclosed. In this process, there is no asymmetry between the two parties during the transaction, which makes it possible to implement a fair contract. The same applies to the distribution procedure. For example, maintaining a network of blockrooms requires the voluntary participation of a miner (for example, PoW), which is rewarded by donating crypto-currency tokens in exchange for their mining activities.

- Solution for the asymmetry of information and the implementation of a fair contract = Technology of Blocking.

- Fair distribution = Distribution of tokens based on the contribution of the system.

PTON ECOSYSTEM

Cost model

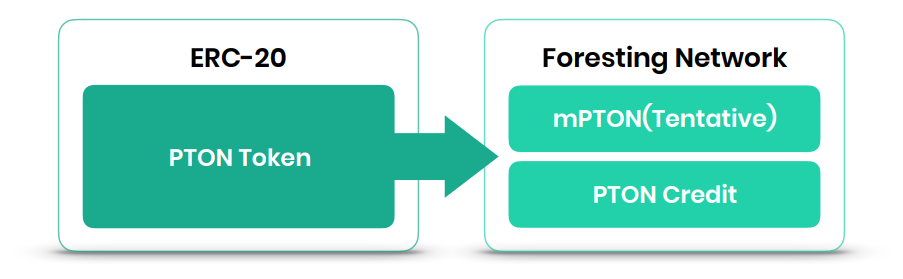

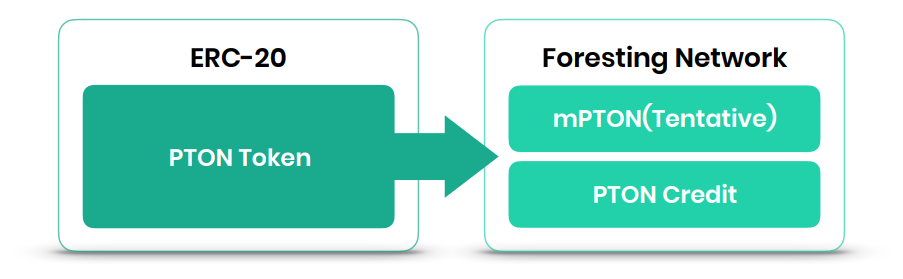

The initial testing system is built on the Ethereum network. As the project progresses, 24 billion Token PTONs are exchanged with coins mPTON (tentative name) with a ratio of 1: 1 after the launch of Mainnet. Foresting Bank and PTON Credit, which is a standard for assessing creditworthiness on the basis of platform contributions related to the creation and storage of content, will manage the economy of tokens.

Before launching Mainnet for reward testing, content delivery before beta testing and super-node operation are managed through payment of PTON tokens. In addition, FORESTING conducts projects faster, more efficiently and more equitably through a management program that encourages the participation of third parties.

In this regard, the cost model to be covered in this sector is the valuation model for launching the FORESTING Mainnet network, the factors for the development of the PTON cost model are as follows.

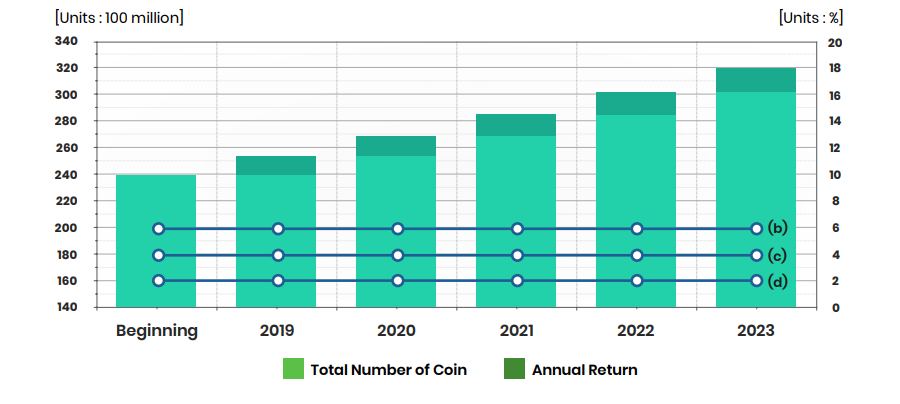

Total number of coins = (a)

Annual profit = Inflation = 6% = (b)

Content

fee = 75% of (b) = (c) Supernode award = 25% of (b) = (d)

Daily coin issued = (b) / 365 = (e)

Users (optimistic) = (f)

Users (conservative) = (f1)

Users (pessimistic) = (f2)

DAU (20% of (f)) = (g)

Laik = Voting (g) * 5) = (h)

Daily coin for content reward ((c) / 365) = (i)

1 like = (x) Coins = (i) / (h) = (j)

Daily content = 20 % from (g) = (k)

Laik for content (((h) / (k)) = (l)

Daily reward for content content = (j) (l) = (m)

Annual profit = Inflation = 6% = (b)

Content

fee = 75% of (b) = (c) Supernode award = 25% of (b) = (d)

Daily coin issued = (b) / 365 = (e)

Users (optimistic) = (f)

Users (conservative) = (f1)

Users (pessimistic) = (f2)

DAU (20% of (f)) = (g)

Laik = Voting (g) * 5) = (h)

Daily coin for content reward ((c) / 365) = (i)

1 like = (x) Coins = (i) / (h) = (j)

Daily content = 20 % from (g) = (k)

Laik for content (((h) / (k)) = (l)

Daily reward for content content = (j) (l) = (m)

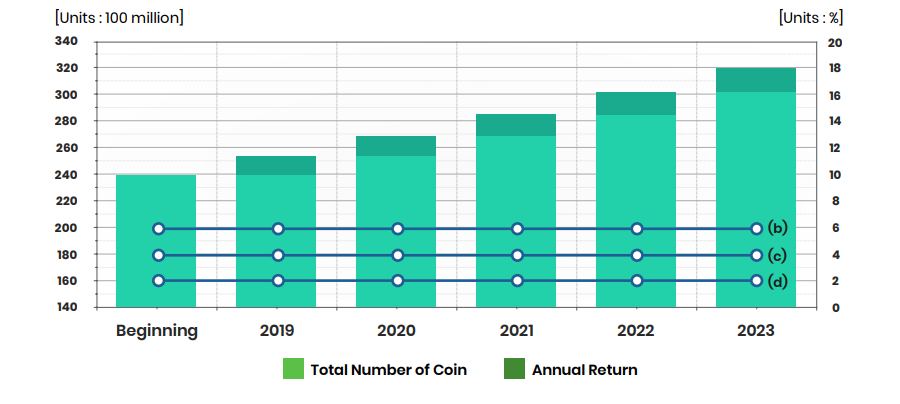

The factor (a) in the table above is mPTON (tentative name), which is exchanged in a 1: 1 ratio with 24 billion existing PTON tokens when Mainnet starts. After that, about 6% of coins will be produced annually. As a result, (c) 4% of the annual income (b) 6% is paid to the content creator and voting participant, and (d) 2% is paid to the network for testing.

(a) = Number of coins issued at the beginning = X = 24,000,000,000

(b) = Annual revenue = Inflation rate = Approximately 6% = C) + d)

(c) = Content fee = 4%

(d) = Awards for Supernodes = 2%

(b) = Annual revenue = Inflation rate = Approximately 6% = C) + d)

(c) = Content fee = 4%

(d) = Awards for Supernodes = 2%

Many block projects are currently being conducted with PoS-methods. In most projects, annual income ranges from 0.5% to 8%. In addition, the total number of coin flows gradually increases over time. But the number of tokens issued on a regular basis will be the same or equal in each period of time, so the compensation paid to the Supernode operator is gradually reduced.

Nevertheless, to maintain an annual return of 6%, the FORESTING network will increase the absolute volume of publication at the same rate. For this reason, a year after the launch of Mainnet, the total amount of PTON will increase by 6%. However, in 5 years the total cost of PTON will increase not by 30%, but by 34% from the initial entry point.

After 1 Year = X + 0.06 X = 1.06 X = 25 440 000 000

After 5 Years = X (1.06) ^ 5 = 1.34 X = 32 117 413 862

After 5 Years = X (1.06) ^ 5 = 1.34 X = 32 117 413 862

In addition, although the compensation paid to the Supernode is 2%, the limited supernode (32-128, which will be confirmed by further testing) will have 25% of the total revenue of PTON per year. This allows him to receive higher rewards than other PoS projects.

ICO PLANNING

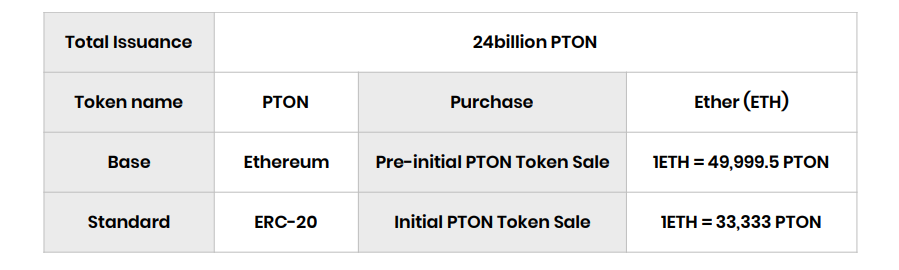

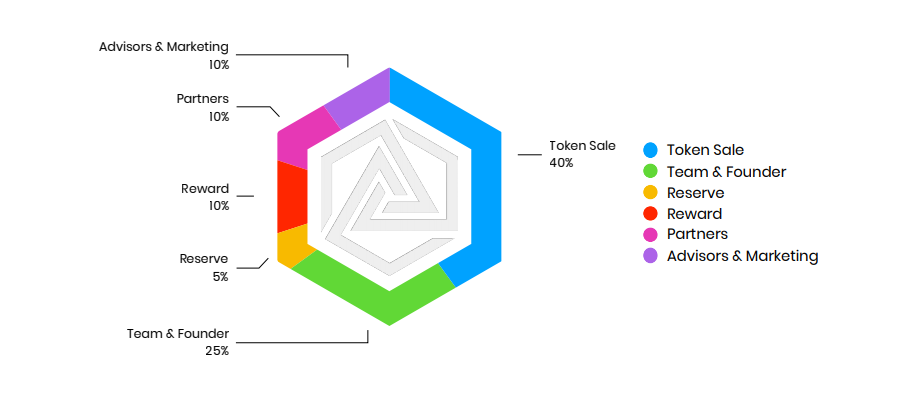

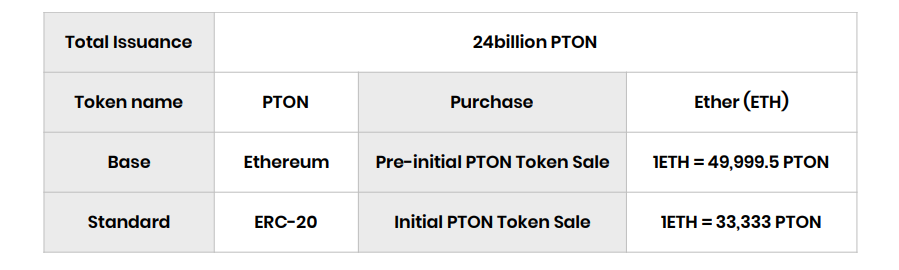

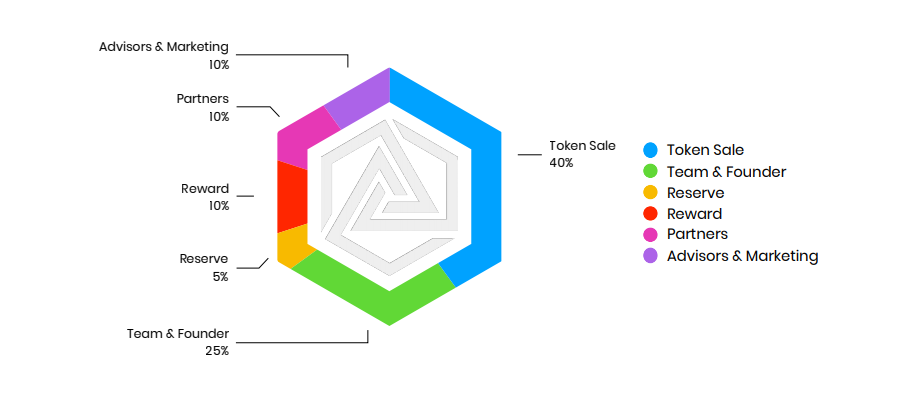

The PTON token will be issued a total of 24,000,000,000 (24 billion) tokens with ERC-20, with 40% of the total set of tokens for sale. ICO participants can receive a swap through the FORESTING currency purse after launching Mainnet FORESTING.

general information

Distribution of tokens

Komentar

Posting Komentar